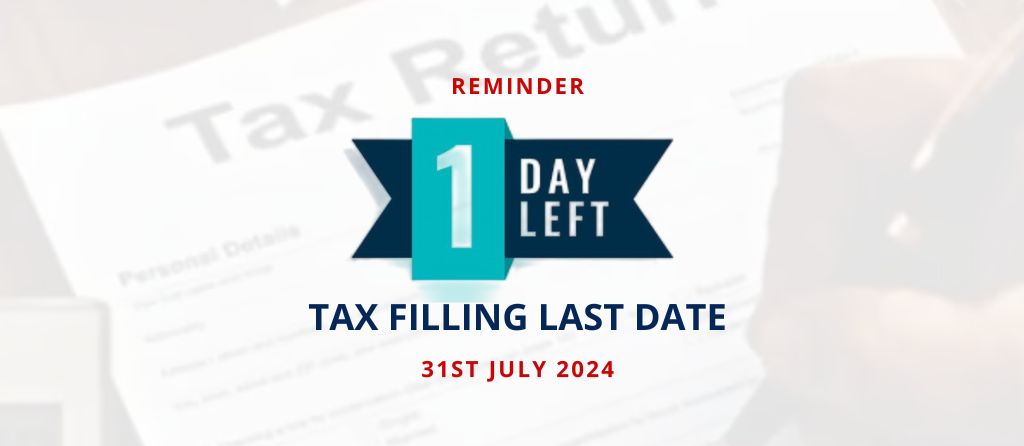

July 31st is the deadline for submitting your 2024 Income Tax Return (ITR). It is essential that all taxpayers file their ITR on time in order to avoid serious penalties and legal ramifications, as the deadline is drawing near.

There are currently just three days left for people to submit their income tax forms. Although more than 4.1 crore individuals have already submitted their taxes, many more have not. There might be severe fines and even jail time if your ITR is not filed by the deadline.

Employers usually manage Tax Deducted at Source (TDS) for salaried workers. However, you are responsible for paying the tax due if you get income from other sources, such as dividends and capital gains. The self-assessment tax option on the e-filing ITR portal can be used to accomplish this. You can use any refund you are entitled to for your salaried income to reduce any other tax obligations you may have.

Legal impact of Not Filing an ITR In India, not filing an ITR or not paying taxes can result in jail time. This is according to the Income Tax Act. The law contains particular measures for non-filing of taxes, income concealment, and misrepresentation, according to legal expert Dhyani from Acom Legal.

You may be subject to a minimum of six months and a maximum of seven years in jail, in addition to a fine, if your tax debt exceeds Rs 25,000. A minimum of three months and a maximum of two years in jail are the penalties for debts under Rs 25,000, in addition to a fine. It is imperative that you file your ITR on time in order to avoid these harsh penalties.

In a noteworthy example from the previous year, a lady in Delhi was given a six-month jail sentence for failing to file her ITR even though it was legally necessary. This demonstrates the dire repercussions of ignoring your tax obligations.

The ITR filing deadline is July 31, 2024, and you must file your return by then to avoid penalties, both financial and legal. Make sure you are following the tax regulations to protect yourself from hefty fines and perhaps jail time.

Don’t delay! File your ITR before July 31, 2024, to avoid penalties and jail time. Visit the e-filing ITR portal today and complete your return. Stay informed and stay compliant.